What is Dividend Yield?

Dividend yield is the annual dividend payment divided by the stock price, expressed as a percentage. It tells you how much income you receive for every dollar invested.

The Formula

Dividend Yield = (Annual Dividend per Share ÷ Stock Price) × 100

Example

If a stock pays $4 per year in dividends and trades at $100:

Dividend Yield = ($4 ÷ $100) × 100 = 4%

What Is a Good Dividend Yield?

- 2-4%: Typical for stable, established companies

- 4-6%: Higher yield, may indicate value opportunity or higher risk

- >6%: Very high yield - investigate sustainability carefully

Important Considerations

A high yield isn't always better. Yields can spike when stock prices fall, which may signal trouble. Always check the payout ratio to ensure the dividend is sustainable.

How Dividend.Direct Uses It

We display current yield on every stock page and use it in our Value Score calculation. We also track the 5-year yield percentile to identify when a stock's yield is historically attractive.

See It in Action

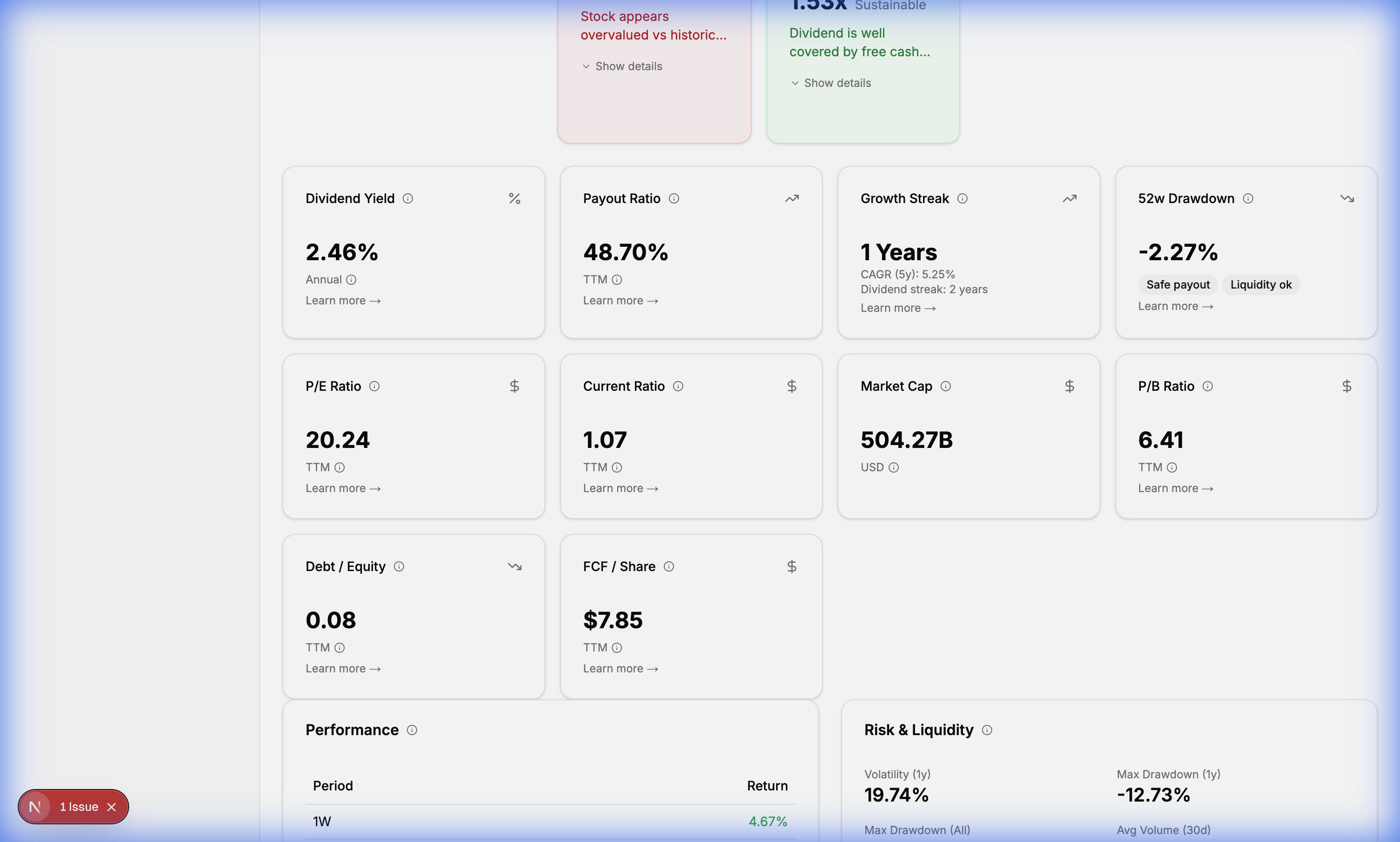

You can find the Dividend Yield card in the "Key Metrics" section of any stock page on Dividend.Direct.