P/E Ratio: Price to Earnings

The P/E ratio measures how much investors pay for each dollar of earnings. It's the most common stock valuation metric.

The Formula

P/E Ratio = Stock Price ÷ Earnings per Share

What Is a Good P/E?

- <15: Potentially undervalued, or slow-growth company

- 15-25: Fair value for most companies

- >25: Premium valuation, high growth expected

Important Context

P/E varies dramatically by sector. Utilities typically trade at 15-18x, while tech stocks often exceed 30x. Always compare to sector peers.

How Dividend.Direct Uses It

P/E ratio contributes to our Value Score. We also track the P/E percentile (where current P/E sits vs. 5-year history) to identify relative value.

See It in Action

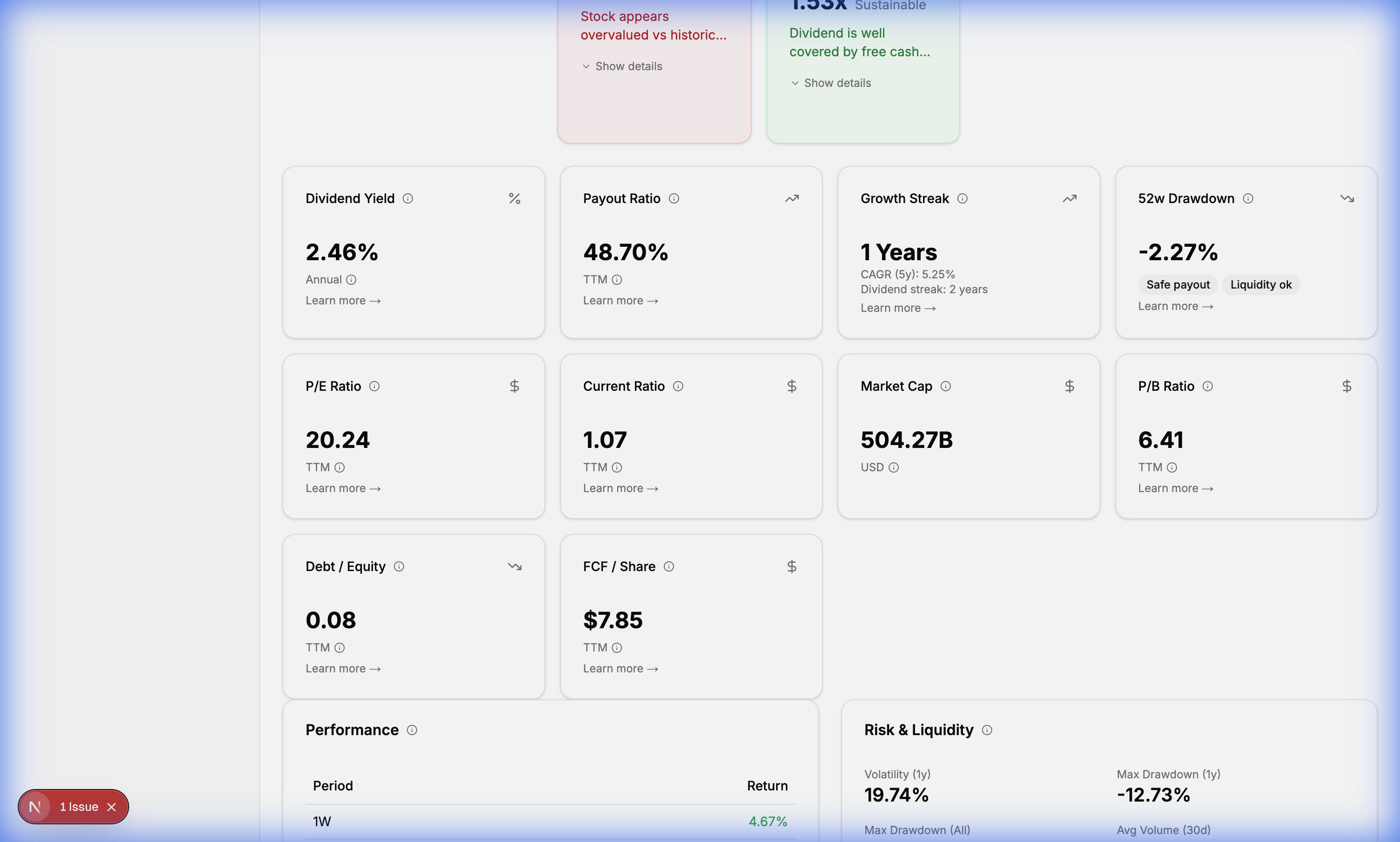

Check the P/E Ratio in the Key Metrics section to quickly assess valuation relative to earnings.