The Tier System

Dividend.Direct classifies dividend stocks into four tiers based on Quality Score and Opportunity Rank.

Tier Definitions

| Tier | Quality | Opportunity | Description |

|---|---|---|---|

| T1 | ≥70 | ≥80 | Premier - Top quality at attractive prices |

| T2 | ≥50 | ≥65 | Strong - Good quality with opportunity |

| T3 | any | ≥50 | Moderate - Some opportunity |

| T4 | any | <50 | Watch - Limited opportunity currently |

What Tiers Mean

- Tier 1: Rare. These stocks combine excellent dividend quality with attractive pricing. Worth immediate attention.

- Tier 2: Strong candidates. Good fundamentals with reasonable opportunity.

- Tier 3: Watchlist candidates. May improve with price drops or dividend increases.

- Tier 4: Lower priority. Quality concerns or poor valuation.

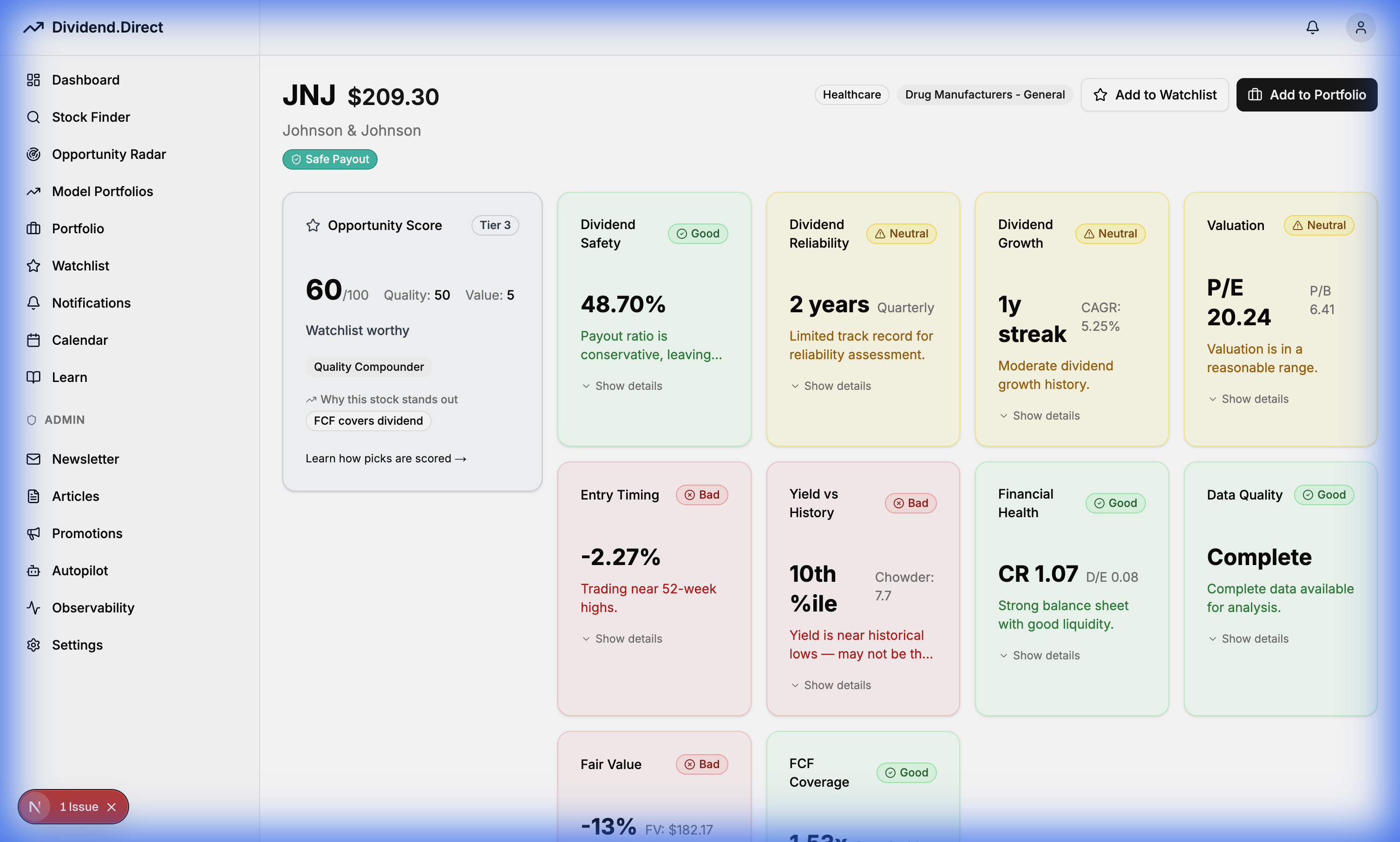

See It in Action

Every stock is clearly labeled with its Tier (T1, T2, T3, T4) so you can instantly gauge its quality and opportunity level.